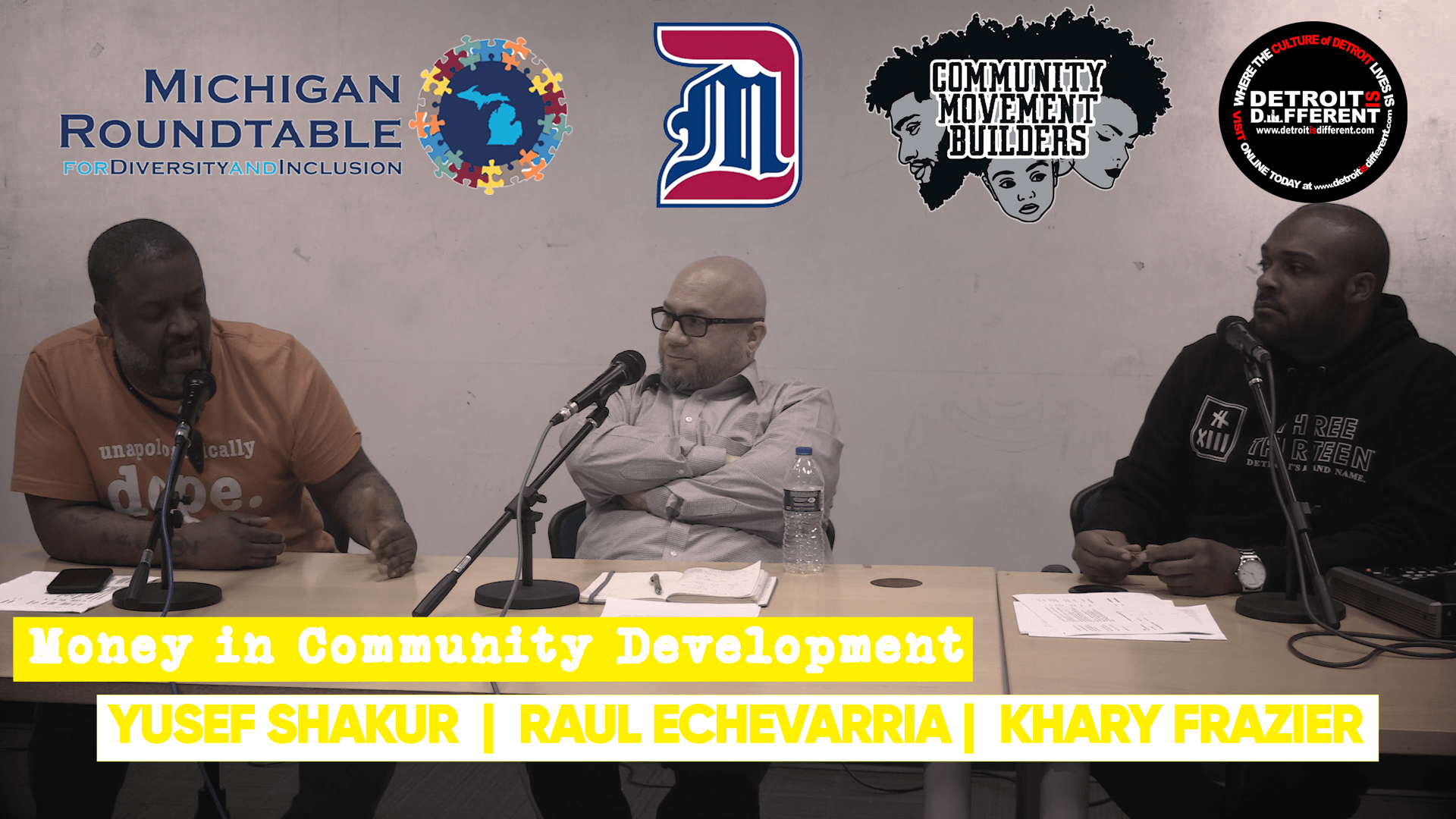

Community Development in Detroit Discussion II featuring Raul Echevarria, Khary Frazier, and Yusef Bunch Shakur Tuesday, March 10, 2020, at the University of Detroit School of Architecture in the Peter Peirce Room.

Presented by Community Movement Builders, Detroit is Different, Michigan Roundtable for Diversity and Inclusion, and the University of Detroit

In this discussion, I (Khary Frazier) framed information and questions to focus on the business (money) of community development.

My premise was many corporations are using the distressed status (perpetually marketed by media of Detroit) to leverage subsidies, tax relief, unchecked lending, and neglectful investment. In this talk defining these practices with Yusef & Raul was important.

CDFI’s (Community Development Financial Institutions) of Detroit have received over 182 Million dollars connected to the CDFI program that was established to assist housing, businesses, and non-profit organizations in community development. The CDFI program was started from the Riegle Community Development and Regulatory Improvement Act of 1994 (here is a link to the act that establishes CDFI’s surprisingly very thorough https://www.fdic.gov/regulations/laws/rules/8000-5400.html). In 1996 the first Detroit CDFI monies from the US Treasury were sent to Shorebank receiving 3.75 million dollars. Here is an article by NYTimes as a brief overview of why Shore Bank failed (according to many financial analysts) https://www.nytimes.com/2010/05/23/business/23cncshorebank.html, many felt that the risks with homeowners were too much for Shorebank.

Currently, CDFI’s have no needed oversight but there is a third party ranking system developed by Aeris that many use to audit their effectiveness. Here is a link to the Aeris website: https://www.aerisinsight.com/ . CDFI’s can also receive funding from banks (like Bank of America) and foundations (like Kresge) in the form of investment and/or grants. Many banks pay for and submit the Aeris audit request to verify the livelihood and financial legitimacy of the CDFI (which I think is problematic because traditional lending has been so racist, here is a great book about the practice released last year: https://www.amazon.com/Color-Money-Black-Racial-Wealth-ebook/dp/B076526LW5).